LegalEASE A Better Solution: A Competitive Analysis- Part I

LegalEASE A Better Solution: A Competitive Analysis- Part I

Annual Legal Plan Industry

Competitive Analysis

Annual Performance Report

2019

Part I

Overview – LegalEASE Plan

Four decades ago, in 1971, the founders of LegalEASE pioneered the development of a group-based legal plan in one of the first ever legal plans. Since that time LegalEASE has created and sold a number of different insurance legal plans and today the LegalEASE legal plan has grown into one of the most developed fully insured legal plans in the employee market today. The LegalEASE Legal Plan provides fully insured group legal services to employers throughout the United States. We have thousands of employees that have elected the LegalGUARD legal benefit.

LegalEASE designed its plans to enable company clients to reduce employee lost work time, significantly decrease employee emotional upset, increase employee productivity, and provide superior services to all Plan Members. Because legal problems can be so debilitating both emotionally and financially, it is critical that a legal plan offers the most coverage in the widely utilized areas of law and the best fit in providers for each employee – providers who will help employees cope with the emotional consequences of legal problems.

LegalEASE’s experience with Corporate Clients

Today the LegalEASE legal plan has grown into one of the most developed fully insured legal plans in the employee market today. The LegalEASE Legal Plan provides fully insured group legal services to employers throughout the United States. We have thousands of employees that have elected the LegalGUARD legal benefit.

In all its business segments, LegalEASE specializes in the comprehensive administration of legal and financial services programs to over 14.8 million employees of over 4,800 corporate client companies, federal, state and local governments, unions, school districts, associations, affinity groups, credit unions and related employee and affinity groups throughout the United States and in parts of the world.

Part I. The Legal Plan Market

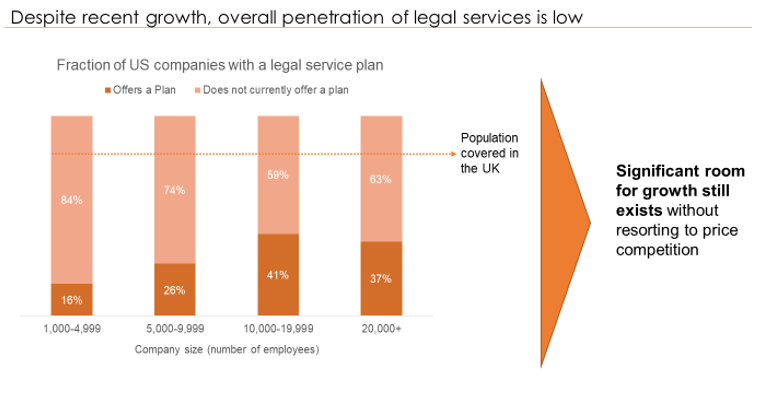

Legal and financial plans for employees comprise a huge multi-million dollar industry that is vastly underserved. Other than the Company, there are two (2) other companies in the national market - that most are already familiar. There are also a few minor players and one large consumer multi-level marketing company offering legal plans. The national companies constitute the primary current competition for the Company although our company is three (3) times as large in network providers and employees covered by some type of legal plan.1

The Company believes there is a secondary legal plan niche that is both too small for concentrated coverage by the two (2) large national companies and that is not well served with broad enough quality services by other smaller, regional legal plans. This secondary market is the smaller group market with an insured plan. Most legal plans duplicate the other's benefits, are not offering fully insured benefits, and spend very little on infrastructure costs and cannot keep up with the service mix that small and mid-size companies are demanding. By providing those quality services now, at a fair price, the Company believes a competitive sales advantage exists that will generate a larger market share.

LegalEASE has grown markedly over the past two years with growth approaching 40%. It has taken a number of larger corporate clients from other competitors in the past few years. LegalEASE has also become the major player in the Voluntary Benefits mid-market.

Other Legal Plan Providers have also gained some market share over the past few years. Their cumulative share of covered insured employees is still is less than 30% of the employee market. These plans are ruled primarily by cost containment structures and a uniform pricing policy. Freedom of choice can be limited - and the network size and scalability are minimal although improving. Many attorneys complain that the freedom of decision is diminishing constantly from time and cost constraints imposed upon them. The client, the individual employee, is equally dissatisfied with this lack of flexibility from the attorneys in the other national networks. Employers have begun to realize that the functionality and performance of the legal plan in year 2 and beyond is a major factor in how employees perceive the value of a legal plan. Who does the tedious “work of finding an attorney” when a legal problem arises has become the critical factor in differentiating legal plans.

The three (3) national legal plan insurance carriers account for 95% of the current market for employee-paid fully insured legal plans in large and medium-sized companies in the US. The majority of small companies either have no coverage or have allowed a large multi-level marketing prepaid legal company to solicit their employees in a legal plan that is not fully insured. This multi-level marketing company has its own marketing and sales programs, which include non-proprietary outside sales. Their coverage includes discounted off hours on rates rather than a fully covered plan.

The market niche for the quality legal plan is at an all-time high in both the jumbo and large, and mid-market. However, services must be of high quality. Many HR Managers are now realizing some legal plans are promising high levels of service but often don't deliver as promised because of the expense of building the internal resources required to compete effectively. LegalEASE, by virtue of its 48 years of building legal plan infrastructure, already has the necessary resources in place.

End Notes

1/ LegalEASE Market Research, 2019.

2/ LegalEASE Employee Health; Legal & Financial Stress Impact Study, 2018, Robert L. Heston, Jr.

3/ Id.

4/ Id.